tax saver plan benefit card

Think and acting like a saver not only means knowing what youre saving for and how much it costs but having a plan for building that savings. Distributions are tax-free if used for qualified disability expenses.

Secure Act Tax Credit Calculator Myubiquity Com

A better score can help unlock the things you want most - like a new credit card or best loan rates in the market.

. Salaries of the employees of both private and public sector organizations are composed of a number of. HRA or House Rent allowance also provides for tax exemptions. A pass-through tax feature demonstrates the impact of the deduction for pass-through income and the phase-out of the deduction under the 2017 Tax Cuts and Jobs Act and a savers credit feature showcases the impact that the savers credit may have on a.

Aditya Birla Sun Life Tax. Stock selection process is driven by fundamental research. Taxation of employer-provided stock options - Employees are subject to tax on the benefit derived from shares provided either for free or at a favourable price by the employer.

Nippon India Tax Saver. These tax saving mutual funds also offer the benefit of maximizing portfolio returns over a long term to an investor. The type and amount of income tax deduction available against repayment of Home Loan is governed by applicable Income Tax Laws of Government of India.

The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. Allows an ABLE accounts designated beneficiary to claim the savers credit for contributions to the account. Important details about this transition were emailed or mailed to HSA participants.

Save tax on your income by taking a home loan. However for the purpose of this new tax regime fair market value for. What is Reliance Tax Saver Plan.

Product Label and Risk Categories. Hence as it stands DDT has been abolished under the new tax regime. The tax benefit applies to the taxpayer the family member or any member of HUF.

Eligible employers may be able to claim a tax credit of up to 5000 for three years for the ordinary and necessary costs of starting a SEP SIMPLE IRA or qualified plan like a 401k plan A tax credit reduces the amount of taxes you may owe on a dollar-for-dollar basis. The surrender value of a life insurance policy is allowed as a tax-free benefit only if it fulfils the below-mentioned conditions If it is a traditional plan like endowment money back etc the surrender value would be tax-free if the premiums of the first two years have been fully paid and then the plan is surrendered. Us Eyes Making H 1b More Flexible For Startups Pacing Up Green Card Process Weight Loss Expert Dr Mohit Bhandari On Metabolic Health And The.

Over the summer HSA participants will transition to a new HSA custodian WealthCare Saver. Increases the amount of contributions allowed to an ABLE account and adds special rules for the increased contribution limit. These changes are an increase from last years Child.

For questions about the transition please call 888-401-5155. A tax credit is granted for dividend income received by an individual domiciled in Thailand from locally incorporated companies. Uses a 5-point evaluation criteria for identifying stocks efficient use of capital earnings growth prospects valuation liquidity and corporate governance.

Income Tax Section 80 HRA. Giving some relief to investors the government today extended indexation benefit for computing tax liability on sale of shares listed after January 31. The death benefit would be fully exempted from tax in the hands of the nominee whatever is the amount.

-Quant Tax Plan 2040 Mirae Asset Tax Saver Fund 1973 Axis Long. DSP Tax Saver Fund. Under the American Rescue Plan Act of 2021 the new Child Tax Credit is a refundable credit worth up to 3600 per qualifying child under 18.

The Tax Cuts and Jobs Act of 2017. You may claim deductions in your income tax against principal and interest payments that you make towards repayment of your home loans. Moreover the exemption would not be allowed on policy benefits received under a Keyman insurance plan under Section 80 DD 3 or under.

Uses a blend of growth and value styles of investment. Section 80C Deduction for FY 2019-20. Nippon Nndia Tax Saver ELSS Fund is a type of mutual fund scheme that primarily invests in the stock market or Equity.

Visit Nippon India Mutual Fund to know more about ELSS. Invesco India Tax Plan. Tata India Tax Savings.

The interest paid on education loans in the country comes under this tax deduction section. Already have a report. Tax Benefit of Mutual Funds.

Debit card Net. An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit.

Balance Sheet Income Statement Financial Etsy Debt Management Plan Best Business To Start Finance

Investment Investing How To Plan Financial Advisory

How To Start Investing A Beginner S Guide Investing Start Investing Investing Money

Pin By Elizabeth Singer On Money Online Shopping Hacks Tax Return Saving

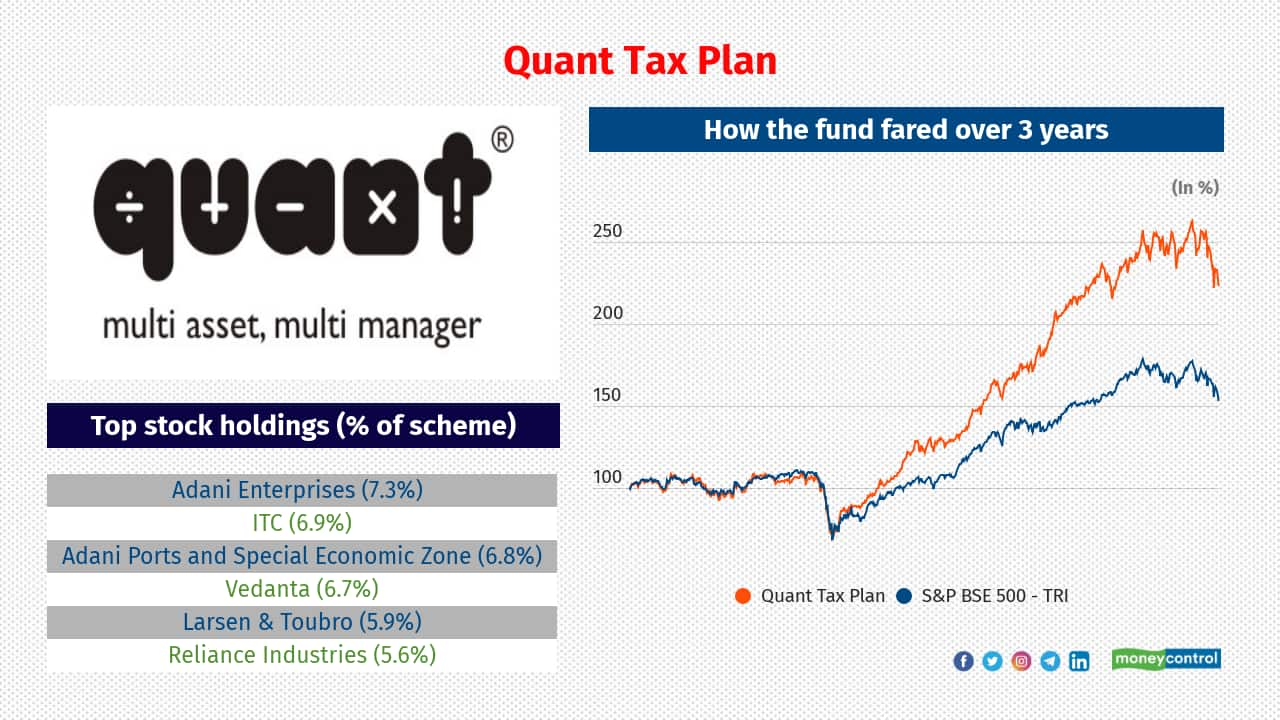

These Tax Saving Mutual Funds Have Given The Best Returns Over Three Years

Planning For Retirement Infographic Preparing For Retirement Retirement Planning How To Plan

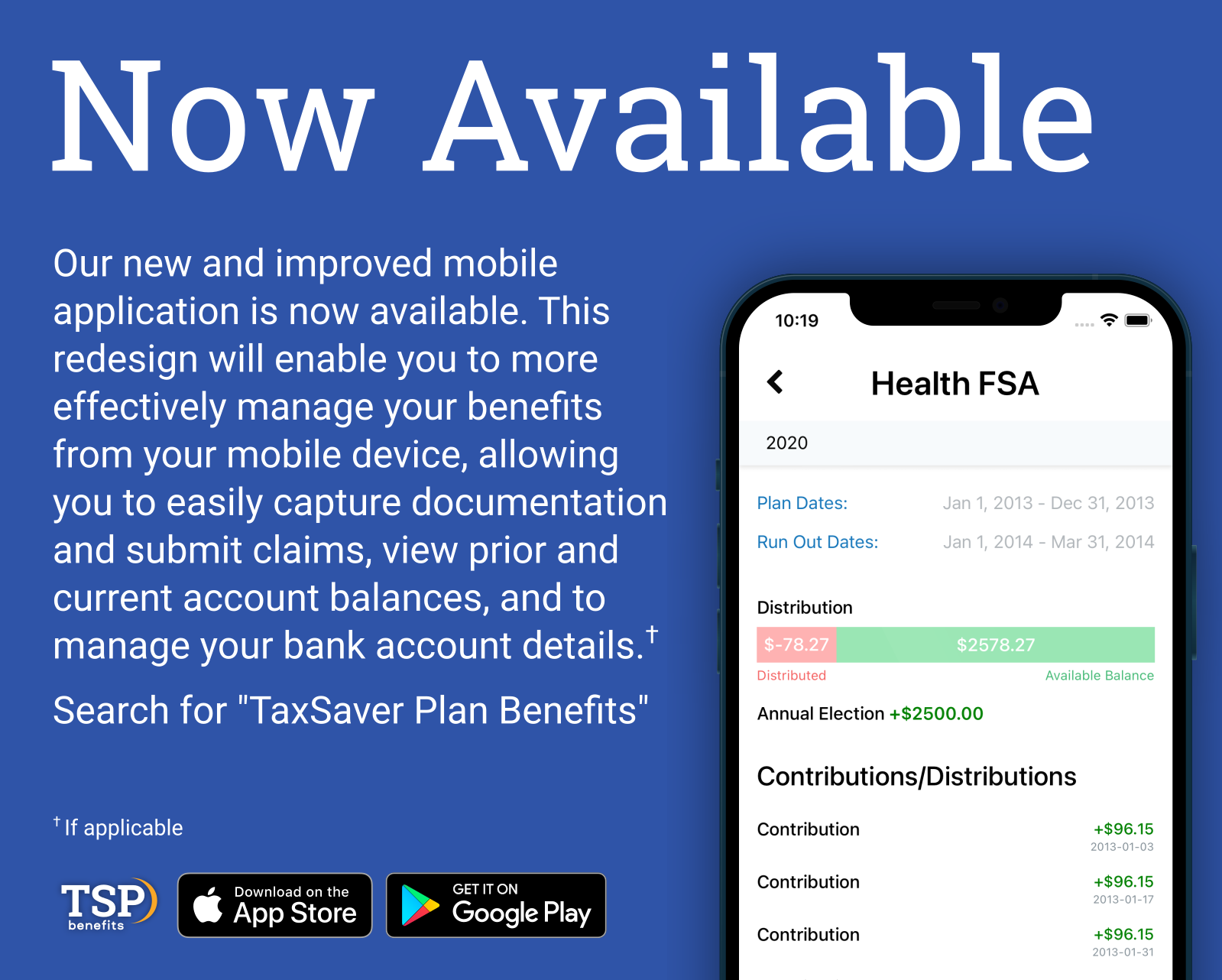

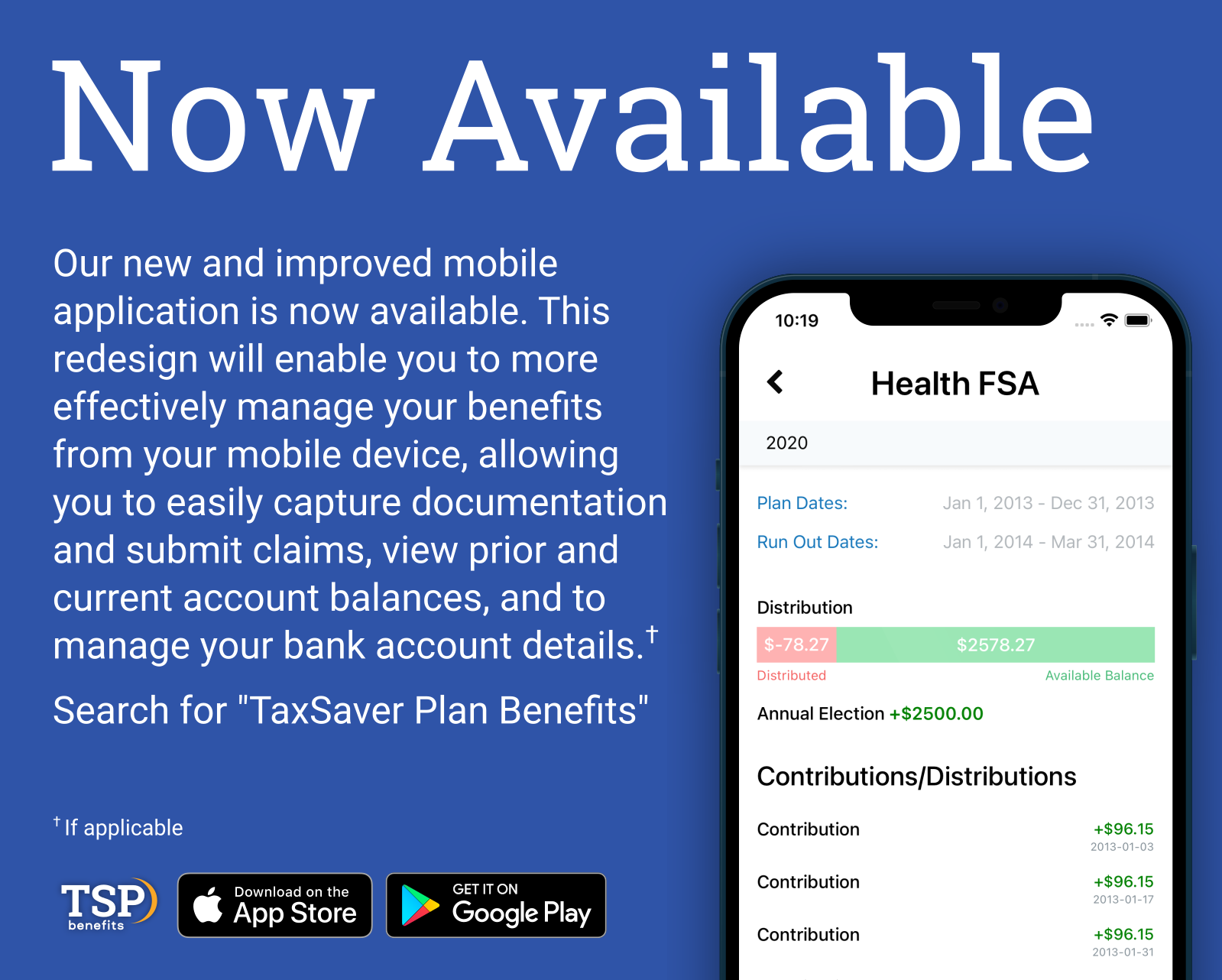

Participant Portal Access Taxsaver Plan

Non Discrimination Testing What You Need To Know Wex Inc

Planner Inserts Debt Payoff Credit Card Interest How To Calculate Credit Card Interest Creditcard Creditc Budgeting Money Budgeting Budgeting Finances

Tarrakki For Mutual Fund Mutuals Funds Mutual Fund

Fillable Form 1310 Irs Forms Fillable Forms Form

Secure Act Tax Credit Calculator Myubiquity Com

Pin By Praveen Lic Advisor On Life Health Insurance Life And Health Insurance Life Insurance Quotes Financial Advisors